As with all aspects of financial life, different periods of time require different views on Assets that a client may hold.

If you have a client who has a large family home now but in retirement they may wish to 'sell down' that asset and use a percentage of that funding into their retirement plans - you can allocate this very quickly and easily with the system.

Step One

- Go to Cash Flow Manager and select the financial position tab

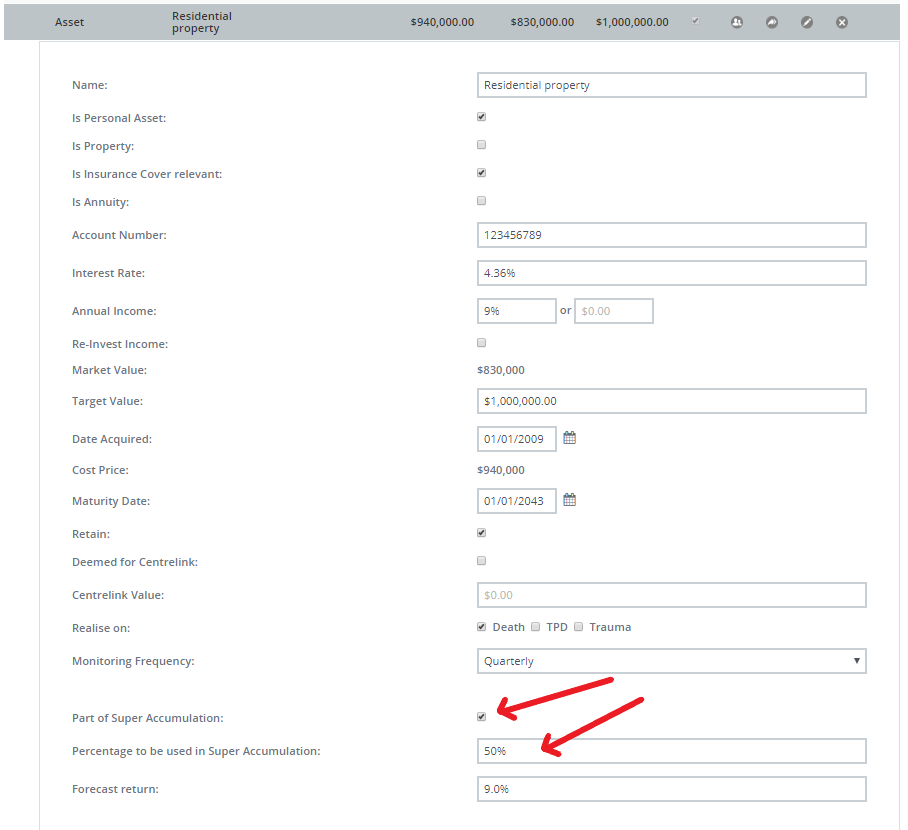

- Next click on the Asset you wish to percentage out for your strategy.

- Next allocate the percentage

- Click the box noted with Super Accumulation if you wish to use it for that

- Click on confirm once you are done.

The system will not allocate that percent of the asset to all its monitoring and calculations using the percentage as a growth perspective.

For example:

Family home valued at $750,000 however your clients believe that when they retire they wont need such a big house and most likely 'sell down ' the asset.

They believe, based on today's cost that they would only need 50% of the value of the house to settle them into their new accommodation requirements levelling the remaining 50% to be used as part of their retirement strategy.

Using this position into the Retirement planning and monitoring tool you will be able to use this future cash value position into the overall retirement goal of your client.

This option is available across ALL assets held by an individual or partner.

0 Comments